By Melanie Slone

The second part of this article, on financial tips for immigrants and deportees, will be published in our December 2025 issue.

“God makes the nets, but he doesn’t put the fish in the nets…you’ve got to go fishing,” says Louis Barajas, one of the first Latino certified financial planners and a financial life coach on the PBS program Opportunity Knocks. “I tell people, you have to save money. It all starts by saving money.”

Achieving financial greatness can feel like an uphill battle, Barajas says. He notes that many people are stuck in the paycheck-to-paycheck cycle without a clear plan to build wealth. But he says change is possible.

Lifting the Community

“I grew up really poor, and I know the struggles that people go through,” says Barajas. Today, he is the first minority on the National Board of the Financial Planning Association and the first on the National Board of the Certified Financial Planner Board of Standards. His experience has made him an expert on Latino and immigrant money issues and the wealth gap, which he is working to close. “I’ve always tried to get Latinos into the financial planning profession, into the industry, to do ethical competent advice in their communities,” he tells us.

The author of five books, Barajas grew up in East Los Angeles with Mexican immigrant parents. When he was 13, he helped his father start a business and file his tax returns, which led him to learn about financial planning. With a master’s in business from UCLA, he later ventured into the world of financial planning, where he became discouraged about the problems Latinos in this country face.

Barajas remembers that in the 1980s, most Latinos in East LA were unbanked, and two neighborhood high schools had a 50% dropout rate. “I wanted to help people open bank accounts and save money,” he says, not sell them products they didn’t understand. Financial planning was a new thing back then, and he got some training in it.

In 1990, he quit his job and went back to the barrio in Boyle Heights to help his community. “I realized that Latinos in poverty did not need financial literacy; they needed to change the financial mindset of how the culture had taught them to think about money.”

His first book was The Latino Journey to Financial Greatness, and he only grew from there. He has participated on CBS, CNN, and National Public Radio as a financial coach and written on the topic in English and Spanish.

Financial Empowerment

“Financial empowerment is different from financial literacy,” says Barajas. “Financial empowerment is when you don’t give somebody else the power to make decisions for you…when you finally believe that if you make certain changes in your life, you can build what I call financial dignity.”

Over the last 40 years, Barajas has learned what works and has seen all the scams out there. “I have worked with people from the bottom who are financially independent 30 years later, 25 years later,” he says. “We’ve worked on changing their cultural beliefs about money and their self-empowerment, their core belief that little changes can make a lot of money.” He reminds us that “poor people, immigrants, even undocumented people have built wealth here in the United States.”

Barajas notes that when you live paycheck to paycheck you have no hope. But “everything starts with saving,” he says. “It is the act of saving that changes your belief that your future can be better.”

Cultural Money Myths

“Money just makes you more of who you are,” says Barajas. “If I give money to a bad person, it’ll magnify who they are. If I give money to a good person, it’ll magnify more of what they can do to help others and provide financial dignity.”

Another Latino cultural belief about money is that they don’t need life insurance. “This is a need, not a want,” he says. “How could somebody say they love their kids and their wife and not have life insurance? …That’s why we want to do the estate plan,” says Barajas, to overcome some cultural beliefs about money.

He also mentions the culture of “chócalas,” or handshakes. “A lot of the people that come to the United States don’t know how to read contracts,” he says, and they believe people who may be scamming them.

Some cultural beliefs holding Latinos back when building wealth include preferring cash, not understanding investments, providing financially for adult children, asking friends for financial advice rather than professional experts, not building credit or cosigning for family members who have bad credit, not asking questions because they are afraid of being a bother or looking foolish, and signing loans without understanding the fine print of the loan agreement.

Every Tuesday Barajas does a live talk in English and Spanish on Facebook, Instagram, and TikTok. People can send him questions about handling their finances. You can reach out to info@louisbarajas.com .

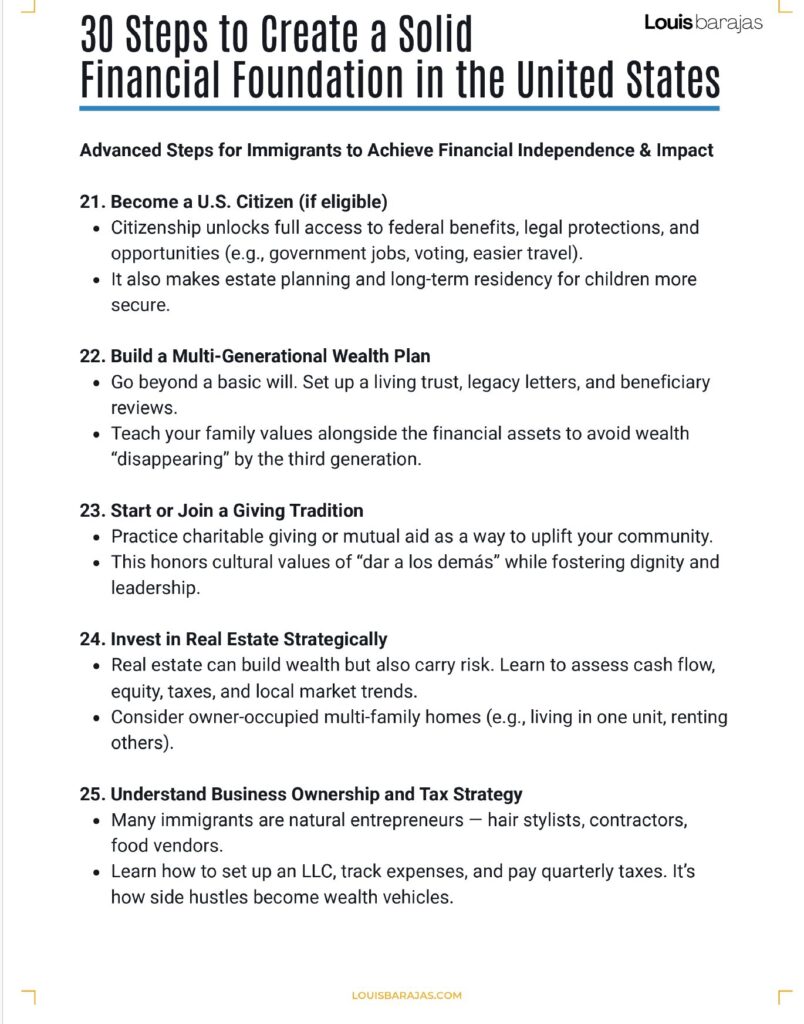

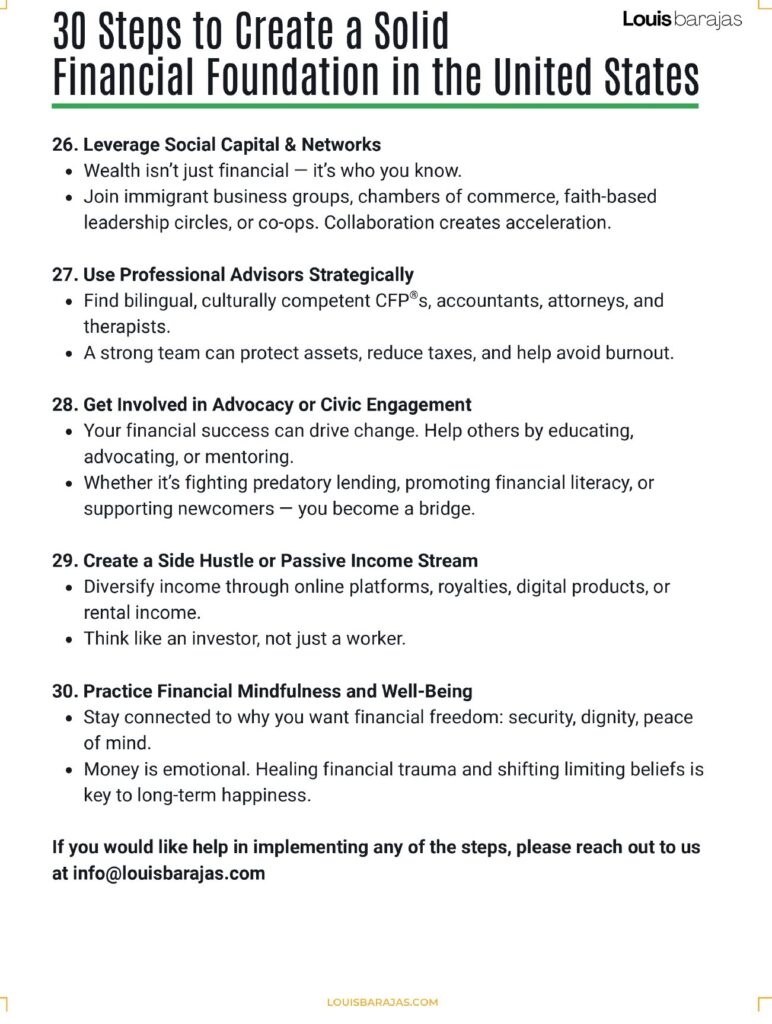

Louis Barajas’ 30 Steps to Create a Solid Financial Foundation in the United States

The ABCs of Wealth

- Attitude: Have a positive, respectful relationship with money.

- Attraction: Focus on creating value, and abundance will follow.

- Belief: Believe you are worthy of wealth and stability.

- Confidence: Don’t be afraid to ask questions or make informed financial decisions.

- Education: Keep learning—money is a language, and it can be learned.

- Humility: Stay grounded, stay generous, and never stop growing.

- Team: Build a circle of trusted advisors, not just friends.

- Worth: Know your self-worth and never confuse it with net worth.

Start at Home

- Start early. Give your children a small allowance tied to age-appropriate tasks. Teach them the value of earning.

- Talk about money. Discuss saving, budgeting, and giving. Show them how to plan and prioritize.

- Model the mindset: Let them see you practice generosity, gratitude, and long-term thinking.