By North County Informador

You can become financially empowered by getting and maintaining good credit.

If you take out a loan at a bank or credit union, they will usually charge you interest until you pay the full loan. Your credit score plays a large role in determining the interest rate you are given, but different institutions offer different rates, so it is important to shop around. The amount you are charged is called the annual percentage rate (APR).

Simple interest applies only to the principal balance, the amount you borrowed. Compound interest includes interest on the principal loan and on the interest from the last payment. As interest increases, so does the amount added to your balance.

Most credit cards do not charge you interest if you pay the full amount you owe by the due date. Interest is applied only to the amount that remains after the due date. If you miss a minimum payment, you are usually charged a fine.

Most auto, student, mortgage, and large personal loans include interest automatically in the monthly payments. You then pay a portion of the interest on the principal and a portion on the interest accrued each month as part of your set monthly payments.

Timing is a significant factor when taking out a loan. The current 30-year fixed mortgage rate is 6.15%, up from 2.86% in September 2021. Check the rate at Freddie Mac. https://www.freddiemac.com/pmms

Check credit card rates at Federal Reserve. https://www.federalreserve.gov/releases/g19/current/

To keep your credit under control, always pay your monthly bill on time, or pay it off entirely if you can. Pay your mortgage and car loans on time. Avoid cash advances because they begin accruing high interest right away.

Improve your credit score by opening accounts that report to the credit bureaus, maintaining low balances, and paying your bills on time. Don’t use credit for everyday purchases if you don’t already have the money to cover it.

You Can Protect Your Credit History

You can check your credit score for free once a year: https://www.annualcreditreport.com/index.action

(877) 322-8228

If you find any discrepancies or charges you did not make, you can dispute it using the instructions on your credit report.

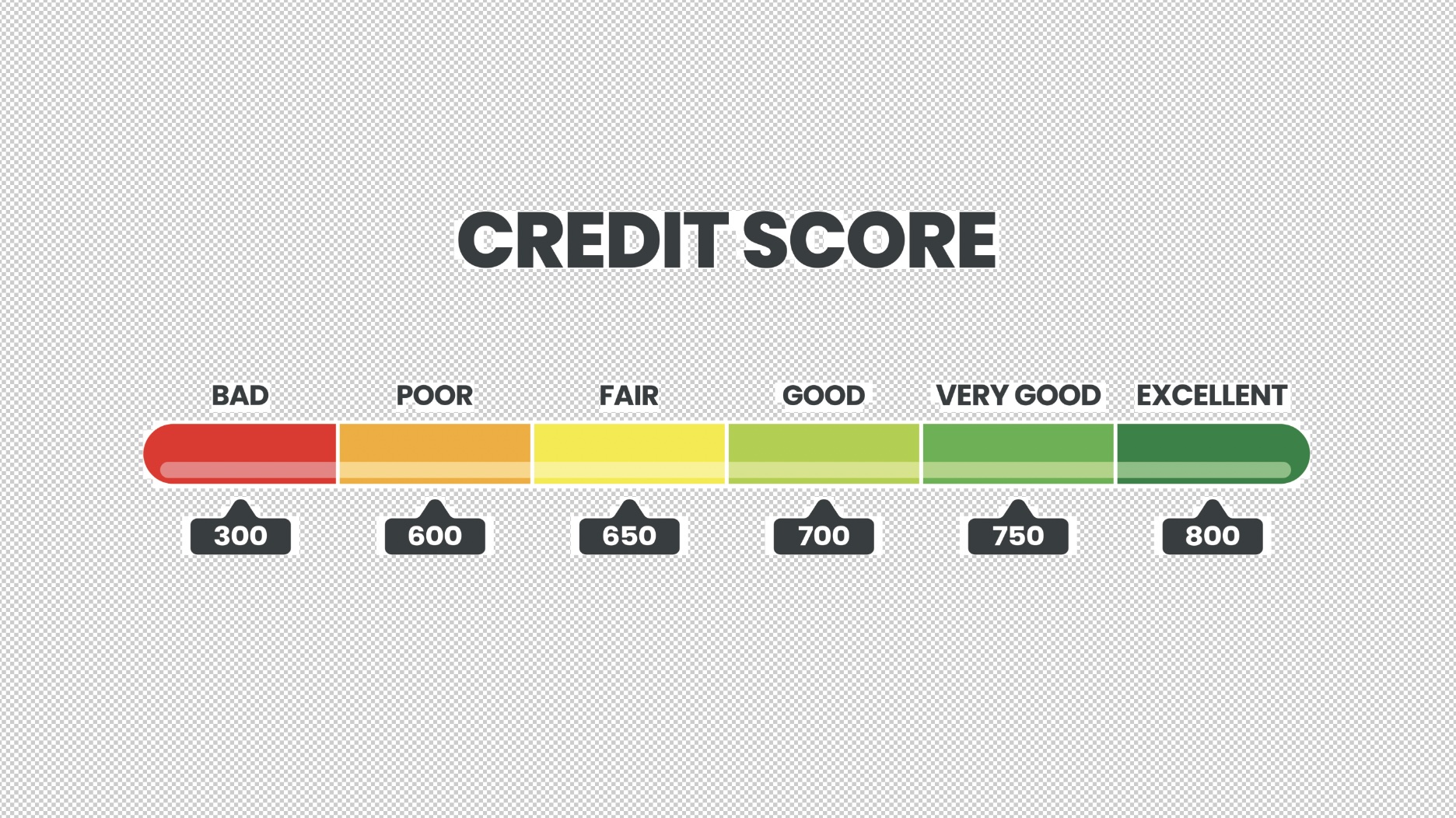

Credit scores range from 300 to 850. They are based on payment history, amount of debt, and length of credit history, among other factors.

What you need to get credit

Proof of income: Tax returns, monthly bank statements, pay stubs, signed letters from employers W-2s, or 1099s (tax forms)

Proof of identity: An official photo ID, like a Real ID or a passport, other state-issued ID, certificate of citizenship, birth certificate, military ID. Most lenders ask for two forms of official ID.

Proof of address: A utility bill in your name, a renter’s or lease agreement in your name. Some lenders accept auto insurance forms with your address on them.

Collateral: For a home or car, the collateral is the object, and the lender can take it back if you don’t make payments. For personal loans, the collateral may be cash or investment accounts, real estate, or precious metals, which the lender will take if you don’t make your payments.

Fees: You may be charged a percentage of the loan for the bank to process your credit.

It is best to prequalify for a loan with a bank or credit union. The terms and interest offered may not be final, but you can use them to compare possible loans from different institutions.

If you have trouble getting credit, you can use a co-signer. This person will be responsible for the loan if you don’t pay it, but often family members will agree to act as one. Once you establish good credit, you shouldn’t need a co-signer anymore.